Building healthy financial habits and embarking on a path to financial security begins with Money Mindfulness. What is Money Mindfulness? Money Mindfulness entails being aware of your financial mindset and making intentional decisions around your money. This includes what you earn, save, spend and give — now and in the future.

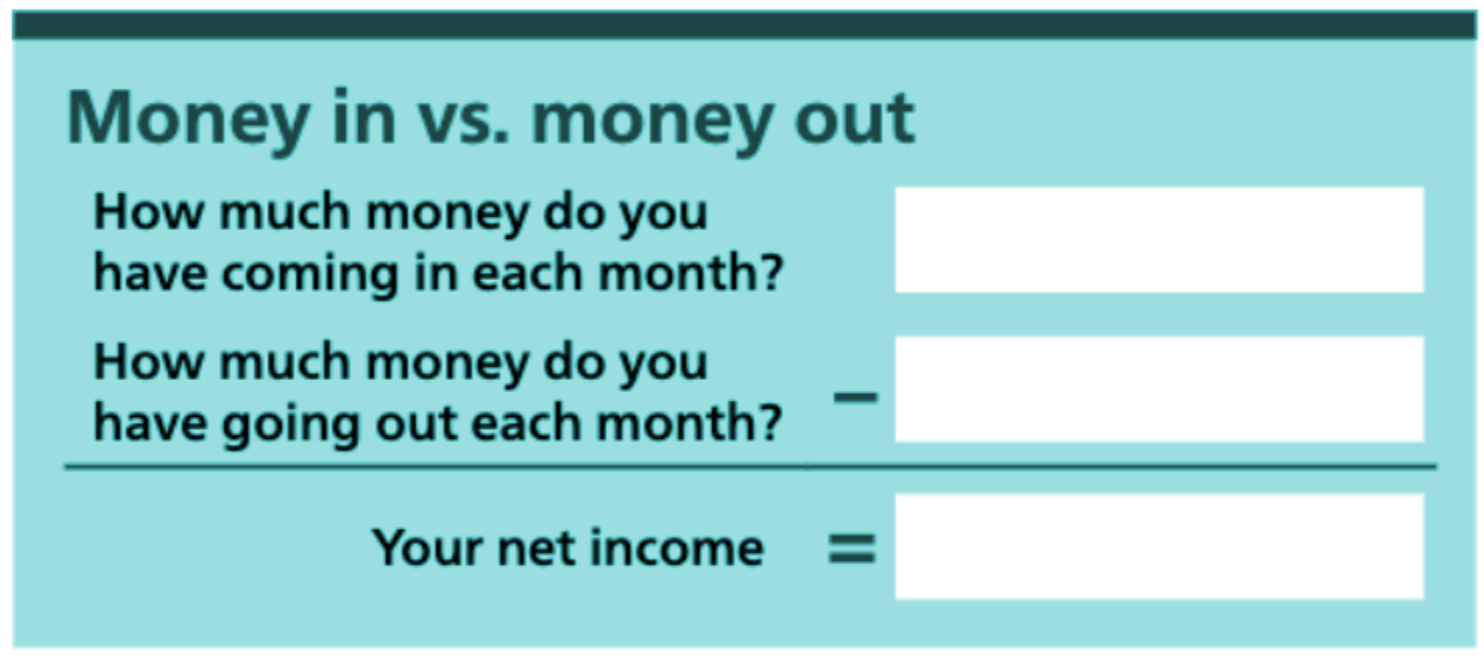

Start small by looking at how much money you have coming in and going out.

If you have more coming in than out, you’re off to a great start! What you do with any leftover income can have a big impact on your financial future. Take some time to reflect on your personal goals and values and make sure that your saving, spending and giving habits are in alignment with those goals and values.

If you have more going out than coming in, that means you’re going into debt. This situation isn’t sustainable and could lead to decisions such as taking on credit card debt or dipping into savings earmarked for retirement to cover expenses, both of which may negatively impact your short- and long-term financial security. If this is the case for you, start by taking a close look at what you’re spending and cut out anything that’s unnecessary.

The NewRetirement Planner will allow you to understand how much money you have coming in and how much money you have going out. Once you’ve done that, you’ll have a long term projection and know where you stand financially and have a powerful tool for making financial decisions and unlocking optimizations.